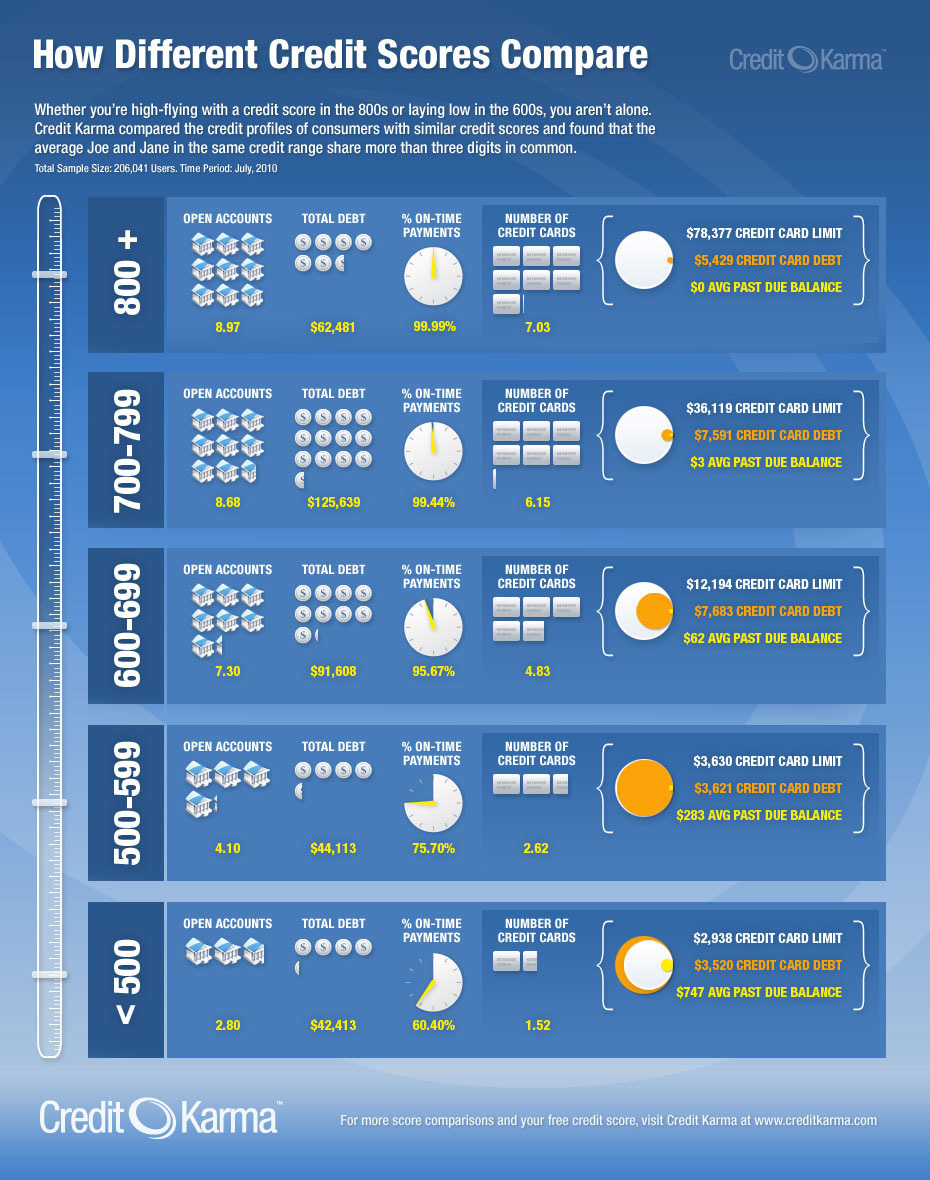

Click to enlarge the infographic below and see what your credit score may say about you and your peers.

The infographic shows what kind of financial doors and credit habits the average consumer in each credit score range has. But keep in mind that when it comes to credit scores, correlation isn’t causality. For example, the infographic shows that people with a high credit score generally also carry a large amount of debt. It might then be easy to think you need excessive debt to have a good credit score. But that isn’t the case at all. The truth is that people with good credit have the score to qualify for credit cards with high limits, loans, and a mortgage, and thus can accumulate large amounts of debt. Poor credit consumers, on the other hand, don’t have a low credit score because they don’t have more debt; they simply don’t have the credit score to even access those kinds of financial opportunities.

Here’s a short guide to understanding the infographic, and how you can use it help make your own credit score soar.

Open Accounts. Having more open credit accounts is good for your credit. You should always consider this credit aspect before closing your old accounts, which can damage your credit score.

Total Debt. It’s credit myth that you need to take out loans or have lots of debt to have good credit. That simply isn’t true. You will notice that people with 800+ credit score actually have less debt that those with 700-799 credit score. There is no exact correlation that more debt equals better credit, but the reality is that only people with good credit can accumulate debt.

On-Time Payments. Paying on time is one of the top drivers of a great credit score. Whether you have a few credit lines or many types of credit, paying all of them on-time is almost a guarantee for a good credit score.

Number of Credit Cards. Credit cards are an easy way to build credit. Contrary to popular belief, carrying a balance or paying interest isn’t what benefits your credit score. Simply using your card once a month and paying on-time is the key to building good credit. There are many people who have never paid a single cent of interest and still have pristine credit by properly using their credit cards.

Total Debt and Utilization. People with good credit actually use a much smaller percentage of their total available credit. Similar to the way they handle debt, good credit consumers know how to manage credit responsibly by keeping their credit card utilization low. For example, people with a credit score in the 800+ range are only using 5% of their credit limits, whereas people with a score in the <500 range are using over 100%.

Lastly, it is important to mention that all of these numbers are averaged and there are still differences across all metrics.